Since the dawn of modern manufacturing, retail prices have been standardized and set by the retailers. There’s been little to no input from or consideration for shoppers beyond the thought of “how can we get the most shoppers to buy our product at a price that still makes a profit.” But with the explosion of technology and rise of digital devices that have put an ever-increasing amount of knowledge and power in consumers’ hands in recent years, that tide is changing. Consumers are taking control of the shopping experience—from where they buy, when they buy and now, even how much they’ll pay.

“The power in the marketplace is shifting from the retailers to the shoppers,” says Giovanni DeMeo, Interactions’ Vice President of Global Marketing and Analytics. “To remain competitive, retailers are going to have to learn to cater to that control and focus on consumers’ needs and demands more than they have in the past.”

Of course, when it comes to pricing, like most things in the retail world, not all customers have the same needs and expectations. Even lowering prices across the board isn’t the answer. It’s true that some shoppers will only buy products on sale. But there are others who deliberately avoid products that have been discounted based on the perception they must somehow be inferior. So how can retailers meet the expectations of shoppers throughout this spectrum while still protecting their bottom line? Enter consumer-centric pricing. This strategy uses elements of Big Data including past purchases and shopper behavior, along with complex analyses and predictive modeling to help retailers adapt to ever-changing market conditions. It allows them to set the right price for the right shopper at the right time to deliver the best balance of consumer value and retailer profit.

Consumer-centric pricing stands in contrast to traditional pricing strategies largely for its more proactive and granular nature. Traditional pricing strategies have long been intuition-based, reactive and applied in broad strokes to large geographic areas and demographic groups. Consumer-centric pricing, on the other hand, capitalizes on technologies such as real-time analytics and mobile apps to allow for quick, data-driven and ongoing price optimization on a more targeted scale. “The expectation on the shopper side is that they’re valued and that somehow the retailer is going to identify them as individuals, not part of the masses,” says DeMeo. “By using technologies like those involved in consumer-centric pricing, retailers have the ability to do that.”

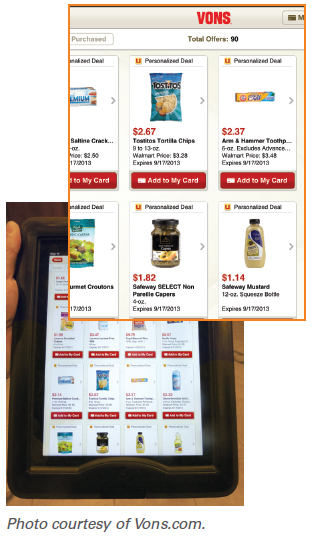

One retailer who is leading the way with customized consumer-centric pricing tied to shopper loyalty is Safeway. Its Just for U™ program allows users who opt-in online or via their mobile devices to load special discounts and deals to their shopper loyalty cards. In addition to retailer coupons and standard in-store specials, shoppers are offered personalized price deals based on previous purchases—or items related to those previously purchased. For example, a shopper who regularly buys cereal but never milk might be offered milk at a lower price to incentivize him or her to buy it there rather than at a competitor. Prices for nearby competitors are often listed below the personalized offer. This shows shoppers exactly what they could be saving by choosing Safeway over the other store.

One retailer who is leading the way with customized consumer-centric pricing tied to shopper loyalty is Safeway. Its Just for U™ program allows users who opt-in online or via their mobile devices to load special discounts and deals to their shopper loyalty cards. In addition to retailer coupons and standard in-store specials, shoppers are offered personalized price deals based on previous purchases—or items related to those previously purchased. For example, a shopper who regularly buys cereal but never milk might be offered milk at a lower price to incentivize him or her to buy it there rather than at a competitor. Prices for nearby competitors are often listed below the personalized offer. This shows shoppers exactly what they could be saving by choosing Safeway over the other store.

The program also allows the retailer to respond to significant events at the local level that may affect purchasing behavior. For example, after a major power outage in Washington, DC, local Just for U users were offered deals to encourage them to restock their freezers.

Launched in 2012, the Just for U program already accounts for 45 percent of Safeway’s sales. In in the first quarter of 2013 alone, it helped increase same-store sales by 1.5 percent. “The Just for U user becomes more loyal and spends more money,” said Steve Burd, Safeway’s recently retired CEO, in the company’s first quarter 2013 earnings call. “With Just for U, there is so much additional value you can bring as you learn more about the shoppers… We don’t see the sales increase from that flattening at all.”

Stop & Shop is taking consumer-centric pricing one step further by incorporating location-based tracking technologies. Through its “Scan It!” app, available on mobile phones or in-store scanners, users scan and bag their own groceries as they move through the store. This allows the retailer to monitor shoppers’ movement.  In turn, targeted offers can be sent depending on where shoppers are in the store and what else they might have in their cart. For example, a shopper who has scanned a carton of ice cream might be offered a deal on ice cream cones as he or she passes the end cap where they are located. “Eventually, we see this type of technology getting to the point where a retailer can track when a shopper moves away from his or her cart or stands in one area for a long time, indicating some hesitation on whether to buy, enabling them to instantly send an individualized offer to help capture the sale,” says Abhi Beniwal, Interactions’ Senior Vice President of Global IT.

In turn, targeted offers can be sent depending on where shoppers are in the store and what else they might have in their cart. For example, a shopper who has scanned a carton of ice cream might be offered a deal on ice cream cones as he or she passes the end cap where they are located. “Eventually, we see this type of technology getting to the point where a retailer can track when a shopper moves away from his or her cart or stands in one area for a long time, indicating some hesitation on whether to buy, enabling them to instantly send an individualized offer to help capture the sale,” says Abhi Beniwal, Interactions’ Senior Vice President of Global IT.

As with any data-driven initiative, there are challenges in adopting a consumer-centric pricing strategy. There are up-front costs involved with building the infrastructure to collect, process and protect customer data. There is also the need to build a qualified team and knowledge base in order to create statistical models, perform analyses and determine ROI. But these challenges can be overcome with dedicated investments and a cultural commitment to the new data-driven retail reality. And the real upside is that technology-based consumer-centric pricing models have the potential to reach all shoppers on some level. Historically, many loyalty and special pricing programs have focused on the minority of shoppers who represent the majority of purchases. But once the infrastructure is in place, it costs no more to analyze the behavior of 20 percent of shoppers via consumer-centric pricing models than it does to analyze that of all shoppers. This creates huge potential to win over those consumers who have traditionally been marginalized by loyalty and discount programs.

The bottom line is that retailers can no longer afford to view pricing as one-size-fits-all—or even one-size-fits-an-entire-demographic. To capture today’s connected consumer, just as with almost every other element of the retail experience, retailers must offer customized pricing that shows they understand and value shoppers’ unique needs and wants.