By Retail News Insider

By Retail News Insider

For years, experts have been predicting that mobile wallets—the ability to pay with the swipe of your cell phone—will be the next big thing. But for nearly just as long, they remained largely a novelty, or sometimes even a nuisance. Now their time has finally come. Mainstream mobile wallet solutions that consumers actually want to use—and retailers can actually synchronize with their systems—are finally here. And they’re set to become even more popular than many retailers may be ready for.

The proof? For starters, Interactions’ latest Retail Perceptions trend report (available at www.interactionsmarketing.com/retailperceptions) shows that nearly 30 percent of shoppers are already using a mobile wallet—and 62 percent of those who don’t say they expect to start using one within the next year. Add to that the fact that all of the major credit card networks in the U.S. participate in at least one mobile wallet solution—and it’s clear that this is a trend that can’t be ignored. This month, Retail News Insider gives you the latest look at what technologies are out there, what they mean for retailers and what the future holds for the industry.

Today’s Mobile Wallet Leaders

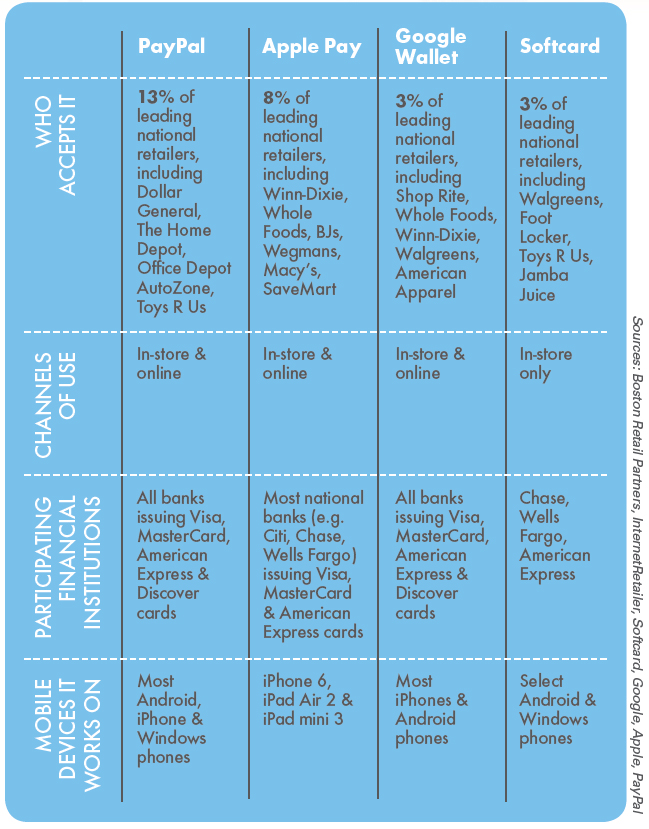

Search the Google Play or iTunes app stores and you’ll find a myriad of mobile wallet options. Some only work with credit cards issued by a specific bank, others work only at certain stores. But with few exceptions (see below), the biggest players today are those mobile solutions that work with multiple banks, forms of payments and/or retailers. Here’s a roundup of four of the most popular choices.

It’s important to note that any discussion of mobile wallets can’t be complete without mentioning Starbucks. While its app only enables payment at its own stores, it has been hugely successful—and stands as a testament to the potential success of mobile payment solutions. Today, the app handles an estimated 6 to 7 million transactions per week—nearly 16 percent of Starbucks’ U.S. sales.

Why Now?

Why Now?

PayPal, Google Wallet and proprietary payment apps have been around for several years. So why are they just catching on now? “Apple Pay is what’s triggered that,” says Dave Berry, Chief Information Officer for Daymon Worldwide. “Apple has really set up a global infrastructure capability that resets the notion of mobile payments. Google tends to be on the fringe and comes up with cool ideas, but when Apple comes up with it, it tends to have more stickiness and be more serious across the globe.”

To Berry’s point, Apple has significantly heightened retailers’ awareness of newer mobile payment solutions that can be more easily integrated into existing point-of-sale (POS) systems using third party hardware and software—a significant change from many of the earlier payment solutions that came to market.

Along with the growing awareness and ease of integration on the retailer side come consumers’ growing expectations. A seamless experience in a retailer’s store, on its Web site and through its mobile app is increasingly becoming a must-have, not just a nice-to-have. Mobile payment systems can help further that omnichannel experience for consumers. They may also provide an extra layer of security for consumers as compared to a traditional credit card swipe. Many solutions require users to enter a PIN, password or fingerprint before making a charge—and allow users to suspend or cancel their mobile wallets instantaneously if their phone is lost.

What’s Next

Some believe the next big break for widespread mobile wallet adoption may be just on the horizon. CurrentC, a mobile payment solution backed by a consortium of retailer power players including Wal-Mart, Target, CVS, Rite Aid and Best Buy, has been under development since 2012 and is scheduled to launch nationwide later this year. To date, the merchants involved in its development have refused to accept other mobile wallet solutions, significantly limiting their reach.

What remains to be seen, however, is the willingness of shoppers to sign on to CurrentC, which plans to bypass credit card processing fees by tying directly to consumers’ bank accounts. This could potentially mean big savings for retailers. But as Chris Doherty, consumer loyalty expert and Vice President of Galileo Branding, notes, “linking your credit card, which has a higher level of protection, to your mobile payment account is different than linking your bank account. [Retailers will] have to do something to incentivize customers to use it… for low-margin retailers like grocery stores, that may mean giving most or all of those transaction savings back to the customer.”

What remains to be seen, however, is the willingness of shoppers to sign on to CurrentC, which plans to bypass credit card processing fees by tying directly to consumers’ bank accounts. This could potentially mean big savings for retailers. But as Chris Doherty, consumer loyalty expert and Vice President of Galileo Branding, notes, “linking your credit card, which has a higher level of protection, to your mobile payment account is different than linking your bank account. [Retailers will] have to do something to incentivize customers to use it… for low-margin retailers like grocery stores, that may mean giving most or all of those transaction savings back to the customer.”

While on the surface this may seem like a reason not to adopt a mobile payment strategy at all, Doherty notes there is still a significant benefit to be had. Even if a retailer isn’t adding the transaction savings to their profit, they’re still growing consumer loyalty—a tried-and-true solution for increasing repeat sales.

“Mobile payments also have the potential to increase productivity,” adds Berry. “Standing in line, swiping your credit card, signing the receipt—that all takes time and ultimately slows down sales. The speed of mobile payments has the potential to improve foot traffic, throughput and sales. And the net of that is increased revenue generation.”

For retailers looking to join the mobile payment revolution, most experts agree it all comes down to knowing your audience. Will they use a mobile wallet tied to their credit card? What about their checking account? Is there an existing mobile payment system they already use and like that could work for you too? As with so many of the changes affecting the industry today, retailers must remember that consumers are now the one calling the shots. Gathering insights to deliver a solution that clearly takes consumers’ needs and preferences into account is the only way to truly succeed.